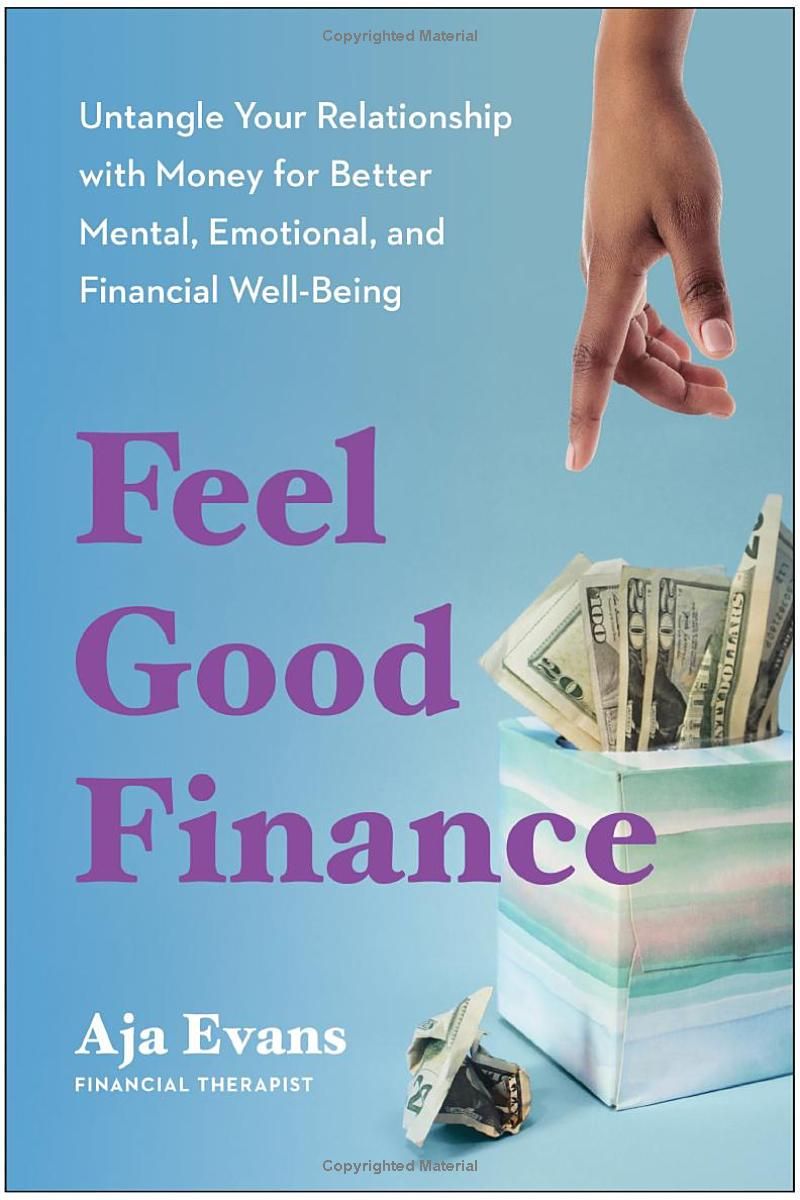

In "Feel-Good Finance," licensed financial therapist Aja Evans tackles the emotional side of personal finances. More than just budgeting, this book explores the deeply personal relationship we have with money and how it impacts our mental and emotional well-being. Evans, known as the "feel-good financial therapist," offers a judgment-free approach, helping readers understand their unique money attitudes and identify limiting beliefs. Through accessible, research-based strategies, the book guides readers toward financial empowerment, covering topics like building generational wealth and overcoming financial anxieties. Whether you're struggling with debt, saving, or simply navigating social financial situations, "Feel-Good Finance" provides the tools and understanding to rewrite your financial narrative and achieve lasting financial freedom.

Review Feel-Good Finance

"Feel-Good Finance: Untangle Your Relationship with Money for Better Mental, Emotional, and Financial Well-Being" by Aja Evans is more than just a personal finance book; it's a supportive companion on a journey toward financial wellness. What struck me most was the book's refreshing approach – it doesn't shy away from the emotional baggage we often carry around money. Instead, it embraces it, acknowledging that our relationship with finances is deeply intertwined with our mental and emotional well-being. This isn't a dry textbook filled with intimidating numbers and jargon; it feels like a conversation with a wise, empathetic friend who understands the struggles and triumphs of navigating the financial world.

Evans masterfully weaves together practical financial advice with insightful psychological explorations. She doesn't just tell you what to do (budget, save, invest), but she delves into the why behind our financial behaviors. Understanding the root causes of our money anxieties – whether rooted in past experiences, societal pressures, or ingrained beliefs – is key to making lasting changes, and Evans provides the tools to do just that. The book's strength lies in its accessibility; the language is clear and relatable, making complex concepts easily digestible. I especially appreciated the inclusion of real-life examples and relatable scenarios, making the material feel less abstract and more applicable to everyday life.

One of the most impactful aspects of the book was its intersectional lens. Evans acknowledges the unique financial challenges faced by women and people of color, highlighting the historical and systemic factors that contribute to financial disparities. This inclusive approach ensures that the advice offered resonates with a diverse readership, making it a valuable resource for everyone regardless of their background. The exercises and prompts throughout the book are thoughtfully designed to encourage self-reflection and promote a deeper understanding of one's personal relationship with money. They're not overwhelming or preachy, but rather gentle nudges toward self-discovery and positive change.

While the book covers essential financial concepts like budgeting and saving, its true value lies in its emphasis on emotional intelligence and self-compassion. It's a book that validates your struggles, encourages self-forgiveness, and empowers you to take control of your financial narrative. It’s a powerful reminder that financial freedom isn't just about having a lot of money; it's about cultivating a healthy and positive relationship with your finances, fostering a sense of security and empowerment. I found "Feel-Good Finance" to be truly transformative, not just in my approach to managing money, but also in understanding my own emotional landscape around finances. It’s a book I would wholeheartedly recommend to anyone looking to improve their financial well-being, regardless of their current financial situation. It’s a book that feels like a hug, a pep talk, and a practical guide all rolled into one.

Information

- Dimensions: 5.56 x 0.18 x 8.25 inches

- Language: English

- Print length: 224

- Publication date: 2024

- Publisher: BenBella Books

Book table of contents

- Where Shall We Begin?

- Chapter 3: Your Psychological Context

- Chapter 4: If I Don't Look at It, It Will Go Away

- Chapter 5: I Need the Fucking Pumpkins

- Chapter 6: Keeping Up with the Joneses

- Money Hoarder

- You Are What You Do

- Chapter 9: Us Home

- Acknowledgments

- Endnotes

Preview Book